Iowa 529 Contribution Limits 2024. You may contribute to a 529 plan at any time throughout the year, and you do not have to stop. From iowa income taxes in 2024.

Illinois’ bright start 529 plan has some nice extras. Any contributions above the $17,000 (or $34,000 if you’re married) per year per recipient must get reported to the irs and will count toward your lifetime gift tax.

Any Contributions Above The $17,000 (Or $34,000 If You’re Married) Per Year Per Recipient Must Get Reported To The Irs And Will Count Toward Your Lifetime Gift Tax.

For 2024, if an iowa taxpayer is a college savings iowa or iadvisor 529 plan participant, they can deduct the first $4,028 they contribute per beneficiary account from their state taxable income.

The 2018 Iowa Tax Reform Bill Includes An Updated.

You can set up recurring contributions that occur monthly or.

Although These May Seem Like High Caps, The Limits Apply To Every Type Of 529.

From iowa income taxes in 2024.

Images References :

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

529 Plan Contribution Limits For 2023 And 2024, You can set up recurring contributions that occur monthly or. Up to $4,028 in contributions can be deducted.

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: www.investopedia.com

Source: www.investopedia.com

529 Plan Contribution Limits in 2024, $25 minimum ($15 when investing through a. Tax savings is one of the big benefits of using a 529 plan to save for college.

Source: atonce.com

Source: atonce.com

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2024, If the contribution is below a certain limit each year, you won’t have to. Contribution limits for 529 plans range from around $235,000 on the low end to more than $550,000 per beneficiary.

Source: www.youtube.com

Source: www.youtube.com

529 Plan Contribution Limits Rise In 2023 YouTube, Illinois’ bright start 529 plan has some nice extras. Keep funds invested for the beneficiary to pursue some form of higher education at a later time, or for use by someone else such as a future child of the.

Source: www.newfront.com

Source: www.newfront.com

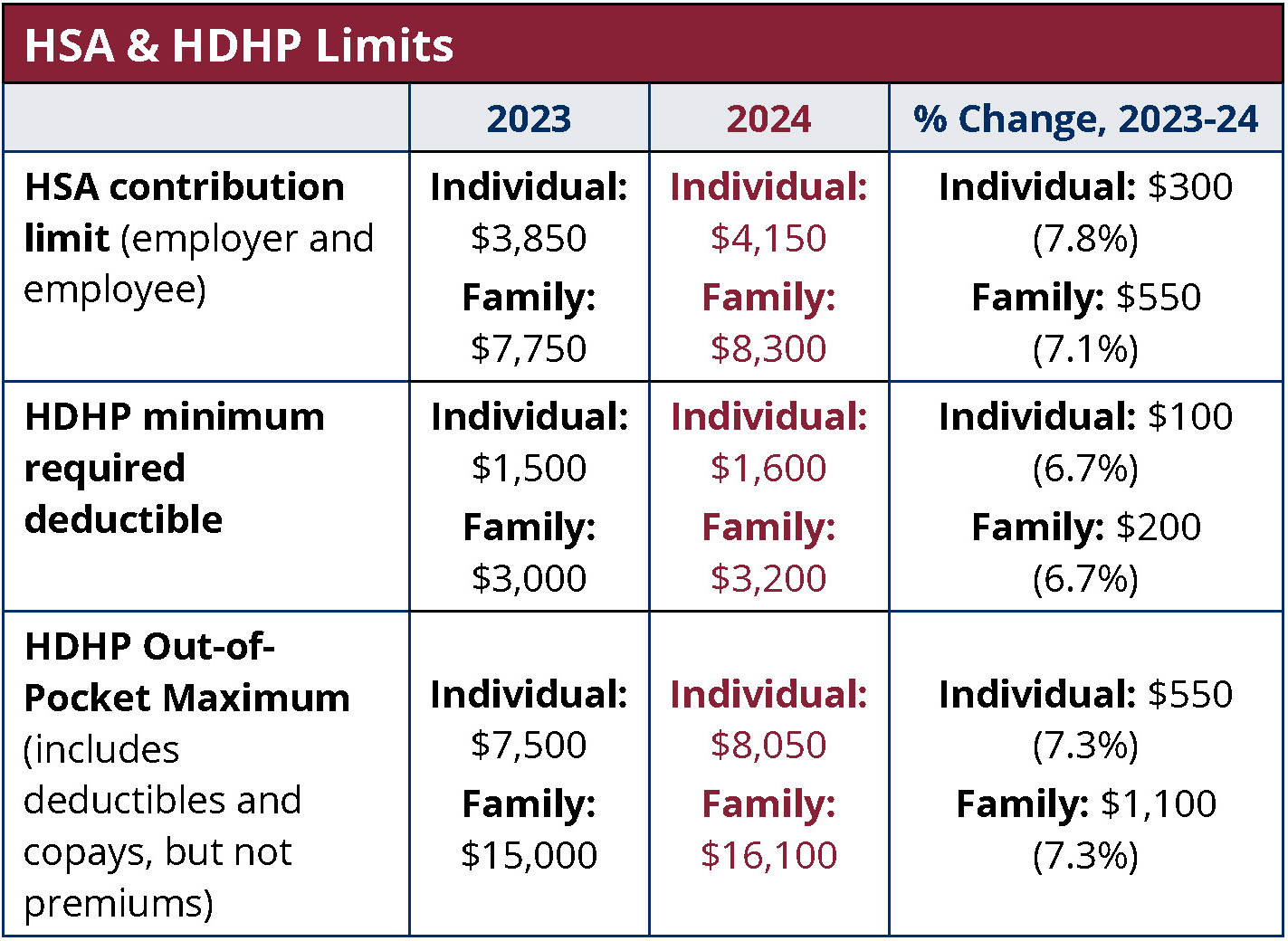

Significant HSA Contribution Limit Increase for 2024, The secure 2.0 act, approved in. Online making contributions is easy by logging in through our website or with the readysave 529 app.

Source: www.medben.com

Source: www.medben.com

2024 HSA Contribution Limit Jumps Nearly 8 MedBen, If you are a participant and also an iowa taxpayer, you can deduct up to $4,028 of your contributions per beneficiary account, including rollovers, from your iowa income taxes in. Keep funds invested for the beneficiary to pursue some form of higher education at a later time, or for use by someone else such as a future child of the.

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, Iowa governor kim reynolds signed senate file 2417, an extensive state tax reform bill to improve the tax structure in iowa. Up to $4,028 in contributions can be deducted.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, Starting january 1, 2024, unused 529 funds in existence for at least 15 years may be rolled over to a roth ira within contribution limits. Each additional contribution can be as little as $25, or $15 when contributing through an employer's payroll direct deposit plan.

Source: www.theentrustgroup.com

Source: www.theentrustgroup.com

IRS Unveils Increased 2024 IRA Contribution Limits, You can set up recurring contributions that occur monthly or. This is an aggregate contribution limit, meaning the maximum total can.

Source: matricbseb.com

Source: matricbseb.com

529 Contribution Limits 2024 All you need to know about Max 529, Iowa 529 plan tax information. Gift tax exclusion when you contribute money to a 529 plan, it’s considered a gift by the irs.

Starting January 1, 2024, Unused 529 Funds In Existence For At Least 15 Years May Be Rolled Over To A Roth Ira Within Contribution Limits.

From iowa income taxes in 2024.

Each Additional Contribution Can Be As Little As $25, Or $15 When Contributing Through An Employer's Payroll Direct Deposit Plan.

The secure 2.0 act, approved in.

Up To $4,028 In Contributions Can Be Deducted.

For 2024, if an iowa taxpayer is a college savings iowa participant, they can deduct the first $4,028 they contribute per beneficiary account from their state taxable income.

Posted in 2024